Is options riskier than stocks? The answer is ... it depends.

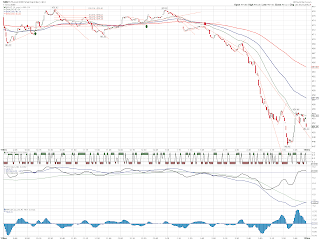

I spend most of my time of market research into NDX-100 related instruments. The ETF QQQQ is a NDX tracking stock and it has an option chain. Let's look at the QQQQ Nov 2008 Calls, the following graph shows the percentages of extrinsic value of the option contract's premium based on the last best bid price on Oct 31st, 2008. The last price of QQQQ on that day was $32.89 and we see that the option premium with their strike price near the stock price has the highest extrinsic value to it. The extrinsic value decreases as the strike prices are farther away from the stock price.

Choice 1:

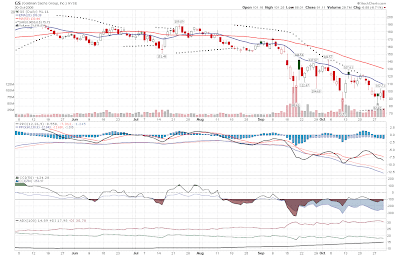

Suppose I wanted to own 100 shares of QQQQ and I can obtain the shares at the price $32.89, the transaction excluding comissions and fees would be $3289.

Choice 2:

On the other hand, I could have purchase 1 QQQQ call option contract deep in the money, say 25% deep where the extrinsic value is less than 0.2% of the option's premium. The last price for the Nov 2008 call 25 option has its last bid as $7.87. The transaction cost is $787 excluding comissions and such.

As we all know, the market can go up, down or sideways. Let's analyze the outcome for each of the 3 scenarios after 2 weeks.

Scenario A) QQQQ price goes up by M dollars.

Choice 1: You have gained $Mx100 in your account, rate or return = 100M/3289

Choice 2: You have also gained $Mx100 in your account, return = 100M/$787, which is about 4 times higher.

Scenario B) QQQQ price is about the same, let's say it is the same.

Choice 1: Zero gain, nothing to lose.

Choice 2: Zero gain, option about to expire, sell the option and pay the extra $1-2 comission.

Scenario C) QQQQ plunged by M dollars.

Choice 1: Your loss = max(100xM, 3289), your risk is $3289

Choice 2: Your loss = max(100xM, 787), your risk is $787. However you will likely loose less capital because as QQQQ price decreases, it moves closer to the strike price of your option contract and the extrinsic value of your option contract will actually increase, the intrinsic value will be decreased by $100xM but the intrinsic part will increase by > 0. Therefore even if M <>

It does look like in all scenarios, the choice 2 seems to have less risk. The only major draw back is you don't earn any dividends and voting power of the underlying stock, but that may not be the most important?

Options with high extrinsic value will likely to loose most of its premium by expiry.

Please note that options trading can carry substantial risk and may not be suitable for everyone, please consult your professional financial advisor and determine the suitability for yourself.