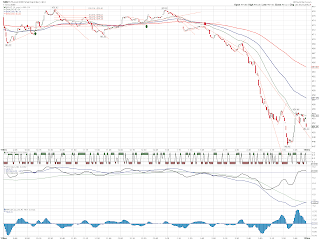

This is the chart for crude futures continous contract since the price peak in the summer ..., who would guess it has dropped nearly 70%? Notice the MACD/PPO has never go back above water, price had few attempts to get back to up but never reach the red 50EMA.

Next is the S&P500 benchmark index for U.S. Equities, since the end of 2007 beginning of recession. Are we sure we are going back up? MACD/PPO is yet to reach zero. ATR is still high but it is slowing coming down. It seems to go side way for a little while before moving up.